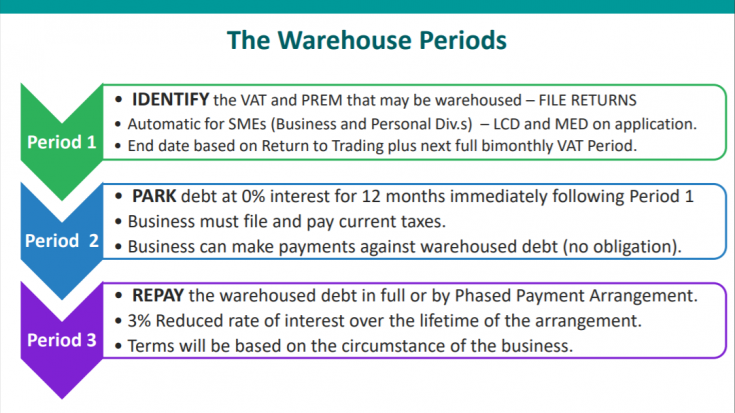

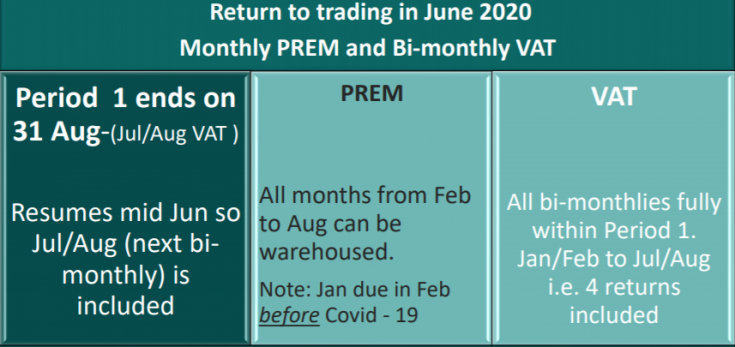

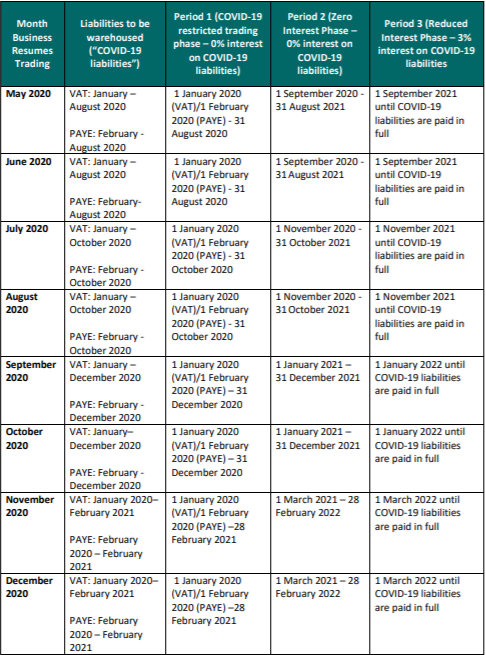

The debt warehousing period is aligned with the Government Roadmap for Reopening Society and Business “the Roadmap” (as provided for in Regulations made under sections 5 and 31A of the Health Act 1947). Businesses that did not close are categorised as resuming to trade in Phase 1 of the Roadmap (i.e. in May 2020). Period 1 for such businesses therefore ended on 31 August. Page 7 of Revenue’s Information Booklet on debt warehousing includes a table outlining when each period begins and ends, depending on the month trade resumes from May until the end of 2020.

Businesses dealt with by Personal and Business Divisions are pre-approved for entry to the warehouse. Entry for taxpayers dealt with by Medium Enterprises Division and Large Corporates Division is by application. In all cases, submission of any outstanding returns is vital to quantify the debt and a requirement in the legislation.

Revenue will notify businesses who qualified for automatic entry and those who have applied for entry to confirm the debt warehoused. In determining Period 1, the default position is to deem businesses to have resumed trading in line with the Roadmap. Revenue understands that some businesses may have recommenced at a later date than the time provided for their type of business/sector in the Roadmap, but the business must provide evidence to support this assertion.

The fact that a business is still subject to some Government restrictions, for example capacity constraints, does not alter the date on which it is deemed to have resumed trading by reference to the Roadmap. The legislation does not distinguish between resuming to trade at a reduced level compared to resuming at a “pre-COVID” level of trading.

Revenue acknowledged that there may be some businesses that do not realise that they are now in Period 2 and have outstanding returns. Revenue confirmed that these businesses will not automatically be disqualified from the warehouse. Revenue will notify these businesses in the first instance to alert them that they have outstanding returns due in respect of Period 1.

Businesses that may have the capacity to pay down some of the debt during the period in which the debt is warehoused (Period 2) can do so, if they wish, to reduce the balance owing before the 3% rate of interest applies (in Period 3). Revenue is examining how best to facilitate such payments.

3% reduced interest rate on certain Phased Payment Arrangements (PPA)

Revenue clarified that the balance of tax due on corporation tax returns filed this month can qualify for the 3% reduced rate of interest on certain PPA, provided that the PPA is entered into by 30 September 2020. Balances of tax due in respect of returns submitted after 30 September, for example, income tax returns submitted during October and November do not qualify for this 3% rate.

In addition, preliminary tax cannot be included in a PPA as it is not a declared liability due to Revenue.

Revenue letters

Revenue have advised that they are issuing notifications to taxpayers that have tax liabilities on record. The letters note the opportunity to include debts in a PPA qualifying for the 3% interest rate before 30 September and the steps to take to avail of this arrangement. The letter also draws attention to other supports, such as Debt Warehousing, EWSS and the Stay and Spend Tax Credit.

Further information and Revenue’s Debt Warehousing Guidelines can be found at: https://www.revenue.ie/en/corporate/communications/documents/debt-warehousing-reduced-interest-measures.pdf